Practice Areas

AWD LAW is here to help.

Divorce & Family Law

Established family law practice to serve clients at a time of personal challenge.

Intellectual Property Attorneys

From Trademarks to Trade Secrets, AWD LAW can help protect your brand and business.

NEW SERVICE: Beneficial Ownership Information Reporting

The Corporate Transparency Act requires U.S. companies, unless exempt, to report their beneficial ownership to the Department of Treasury’s Financial Crimes Enforcement Network (FinCEN).

Visit our BOI page to see if we can help you.

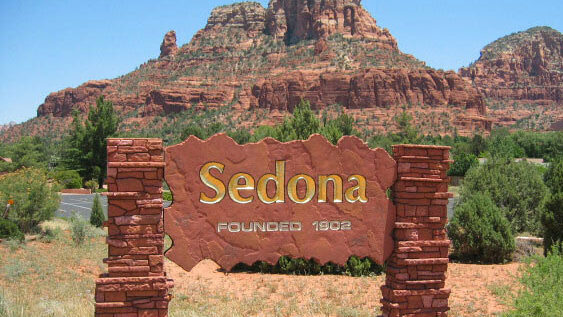

Our Locations

Google Reviews

Mike Wozniak (and the rest of those that helped at AWD), I wanted to let it be known how appreciative my wife, my girls, my family, and I are of you and your office. You have given us faith in humanity. You did everything you could and then some. People always refer to lawyers as “greedy” and about the money, but, because of you I will always beg to differ. Thank you so much for giving us a fighting chance and allowing us to gain some much needed ground. AWD and Mike Wozniak worked tirelessly to get the best outcome possible with my best interest and my goals ALWAYS in mind. You and your office will always have a special place in my heart.

I had a great experience working with Michael and his team. Very responsive and professional. They kept me up to date on all matters, without me having to contact them for updates. I would recommend them to anyone needing legal assistance.

AWD Law is the best in town! When I was looking for someone to help with family law, they were able to help with everything (finances, custody, division, etc.). The team who helped me through my case was absolutely amazing and never left me wondering what was happening next. Jenny Staskey was so helpful the entire time and provided exactly the advice I needed. There were so many finances that needed to be sorted through for the divorce and Jenny was able to walk me through the entire thing. She is an absolute genius with numbers as well as family law! She was my saving grace during all the proceedings. Everyone was very responsive and prompt with anything that was needed or questions that I had. They are very personable and care about you and your case. This team allowed for peace in a stressful time! I would recommend AWD Law firm, specifically, Jenny Staskey, Zach Markham, and Zach Hope 100% of the time! Thank you!

I think Whitney Cunningham is the absolute best lawyer in Flagstaff! He was kind, knowledgeable, kept me apprised of my case as it progressed and answered all of my questions. His high level of professionalism and responsiveness made the legal process easy to understand. I am grateful that Whitney was able to resolve my case. I highly recommend AWD Law for all of your legal needs!

Mike Wozniak helped me out of a toxic marriage. I am so grateful to him! I feel like he understood and empathized with my situation. He did not allow my ex husband to take advantage of me and did not back down. He always replied to me quickly and answered my questions. I also have to complement his staff who were so professional and caring. Thank you Mike for such a great outcome to my case and for my new happy life!

Contact Us!

Please do not provide confidential or sensitive information pertaining to a matter via this form. We are not able to treat that information as privileged or confidential without first entering into an attorney-client relationship. Use of this form does not constitute an attorney-client relationship.

"*" indicates required fields